Bill on the Hill: Accelerated Payments for Small Businesses

By Cate Benedetti, PSC Vice President of Government Relations

The contractor community plays a vital role in assisting the government in meeting daily mission needs and providing services to the American people. In return, companies of all sizes expect a level playing field, fair treatment, and prompt payment for the goods and services they provide. For small businesses in particular, prompt payments are a critical lifeline: a predictable and steady cash flow is necessary to finance day-to-day operations, while concurrently investing in growth and job creation.

Recognizing the impact of delays in payments and the constraints placed on businesses as a result, in 2011, the Office of Management and Budget (OMB) issued a policy directive to federal agencies that required the government to accelerate payments to small businesses and small business subcontractors. Unfortunately, OMB did not renew the subcontractor portion of the directive, and it lapsed on December 31, 2017.

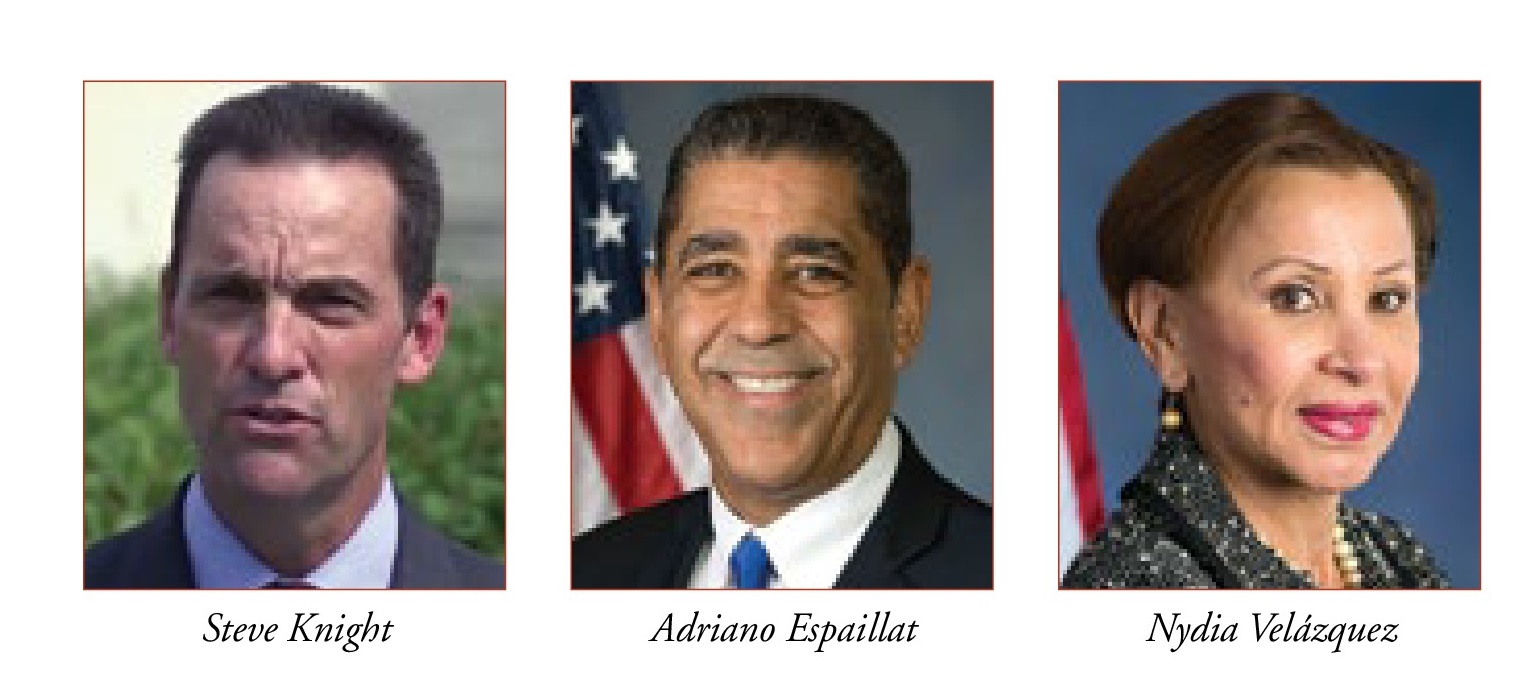

On March 20 of this year, members of the House Small Business Committee introduced the Accelerated Payments for Small Businesses Act of 2018 (H.R. 5337), which will permanently and statutorily require accelerated payments for small businesses and small business subcontractors. PSC reached out to the sponsors of H.R. 5337—House Small Business Committee Ranking Member Nydia Velázquez, Subcommittee on Contracting and Workforce Chairman Steve Knight, and Rep. Adriano Espaillat—to hear more about the new legislation:

What impact has OMB’s policy of accelerated payments to small businesses had on companies that participate—or are seeking to participate—in the federal market?

What impact has OMB’s policy of accelerated payments to small businesses had on companies that participate—or are seeking to participate—in the federal market?

Knight: Small businesses are heavily dependent on a reliable cash flow to ensure their operations are uninterrupted and obligations are met. By accelerating payments to small business contractors, OMB removes a huge disadvantage small businesses have compared to their larger counterparts. This ultimately improves the competitive market by allowing contractors to focus their efforts on improving their production and services to fully utilize every taxpayer dollar.

Espaillat: In the grand scheme, it has inculcated a great deal of confidence in small businesses whose hard work and skills are being recognized and actively sought out by the Federal government. The result is increased access to vital capital and facilitating worth in the small business community. In the process and continuum of supply and procurement, the standard set by the OMB policy has made the federal market more robust and a welcome point of entry for small businesses success and proliferation.

Velázquez: When small businesses receive payments in a timely manner, everyone benefits. In Fiscal Year 2017, over $110 billion in federal contracts were awarded to small firms. Not only does OMB’s accelerated payments policy encourage small firms to apply for federal contracts by granting payments within 15 days, it also opens the doors for new businesses to enter the federal marketplace and create well-paying jobs. However, OMB’s policy is not permanent and small businesses deserve a

lasting commitment that they will be paid in a timely manner. Furthermore, OMB has yet to renew the subcontract part of the accelerated payments policy, allowing it to lapse at the end of 2017. For this reason, it is especially timely for Congress to pass a bill I have proudly co-sponsored to codify OMB’s accelerated payments into law: the Accelerated Payments for Small Businesses Act of 2018 (H.R. 5337).

What would the Accelerated Payments for Small Businesses Act do and why is it important to prioritize this legislation now?

Knight: H.R. 5337 codifies OMB’s accelerated payment policy to ensure that it remains in place regardless of any potential administrative or leadership changes. This consistency will significantly reduce the risk speculation for small businesses and

allow them to plan for the future in their business models.

Espaillat: H.R. 5337, Accelerated Payment for Small Businesses Act, would make it mandatory for the Federal government – that is, any agency or agency-led initiative – to pay prime small business contractors, and larger primes who subcontract with small business, within 15 days of receiving an invoice for services or supplies delivered. This legislation would codify recently lapsed OMB guidance that, since its original issuance in 2011 and later updated, would standardize into law a practice of prompt payment that we should meet as stewards of taxpayer monies and fairness for small businesses that we rely on. There is bipartisan support and drive to address numerous deficits in local, state, and federal infrastructure. The benefits of such an investment will yield micro and macro benefits; but we know, as members of Congress intimately familiar with our Congressional districts and constituents, that they want to be involved in the process because they have a stake in making their lives and communities better. If this process at the federal level is going to be a substantial and long-term commitment, we must ensure small businesses are in the best position possible to make this vision a reality.

Velázquez: By speeding up payments to small companies, this legislation will help small contractors meet payroll, reinvest in their operations, and create high-quality jobs along the way. For small contractors who are keeping their venture afloat one

paycheck at a time, this legislation is a vital lifeline. Moreover, this bipartisan bill came about after numerous firsthand conversations with entrepreneurs who were forced to suffer needless delays while trying to receive an earned payment for

federal contracting work. It is incumbent upon Congress to pass this bill, which would codify OMB’s accelerated policy of ensuring that small businesses receive payments from the federal government within 15 days of receiving an invoice. As Democrats on the Committee, we are constantly striving to help disadvantaged small businesses secure reliable capital and federal contracts. By guaranteeing a quick payment process, it is my hope that we can encourage women and minority-owned businesses—who may generally be more risk-adverse—to participate in greater numbers in the federal contracting marketplace.

What are the prospects for the enactment of the Accelerated Payments for Small Businesses Act this Congress?

Knight: This bill has received early bipartisan support from my colleagues here in Congress. Of note is the support of Chairman Steve Chabot and Ranking Member Nydia Velázquez of the House Small Business Committee. I am optimistic that we will

be able to push this bill to the finish line and deliver this law to small business contractors across the country.

Espaillat: I will give you a direct and honest answer: enactment of this bill begins with Speaker Ryan. It is his prerogative to exercise Rule I, clause 6 of the Standing Rules of the House to allow for a vote on legislation. Period. What I can say is that if I

were to take 533 meetings with each sitting U.S. Representative and U.S. Senator, I would not find any opposition to this bill. This is commonsense legislation that doesn’t require an advanced degree; some yet-to-be quantified “political skill,” or

position as a member of Congress to see that this legislation stands on its intention, merits, and goal.

Velázquez: Well, the bill was introduced very recently and, therefore, will first have to pass in Committee before moving in the full House. That being said, this is a commonsense reform that enjoys bipartisan support. As Ranking Member of the

House Committee on Small Business, I can say that members on both sides of the aisle are eager to come together and do what is best to grow and support America’s vast network of small businesses.

--This article appeared in the Spring 2018

Service Contractor Magazine.

Click here to view the PDF version of this article--