Government Services: A View from Wall Street

By Edward Caso, Jr., CFA Managing Director, Senior AnalystIT/BPO Services, Wells Fargo | April 27, 2018

The light at the end of the “BCA Tunnel” was not an oncoming train after all, but the prospects for renewed growth. In addition, the once distant glow has also proved to be much brighter than we believe anyone thought possible even a few months ago. And, this comes on the heels of federal tax reform that has given a major financial lift for nearly all the federal government focused service providers, who historically have been near marginal tax rate payers. So, calendar 2018 has gotten off to a great start and is one that we believe will have legs for some time.

In recent weeks, Congress has passed and the President has signed legislation to increase the level of discretionary federal spending by about $150 billion in each of the next two government fiscal years (GFYs). In December, Congress approved legislation that reduced the federal tax rate to 21% with most service providers now indicating expected overall tax expense rates in the 23-26% range down from the mid-30%s. So, more client dollars to pursue and more bid & proposal dollars to pursue them.

So what do we see? Several years of strong demand, with a particularly high growth rate in calendar 2019, combined with a modest upward bias in EBITDA margin. This should lead to strong free cash flow generation freeing up financial resources to enhance investor return or invest in market expanding acquisitions. So, in our view, a great time to be an investor in federal government focused service providers.

The good news:

- Dramatically expanded addressable market for both Information Technology (IT) and mission support services.

- The sizeable increase in the Budget Control Act

(BCA) of 2011 spending caps effectively eliminates “sequestration” relative to the prior spending increase line, and we doubt that Congress will back track to the BCA caps for GFY20 and beyond that are still the law of the land.

- While the initial Trump Administration plan was to have “FedCiv” be a bill payer for increased national defense spending, the budget deal has them enjoying significant funding upticks as well.

- Focus turning to more enduring offerings such as readiness & training, IT modernization, and cybersecurity as compared to the 2000s bias to warfighter support.

- Clients that are looking to capture the advantages of IT modernization (e.g. mobile phone applications) that are already embraced in the commercial market.

- Pricing pressure should moderate as budget tightness wanes and the use of low-price/ technically acceptable (LP/TA) contracting is constrained by law.

- Earnings and free cash flow generation is enhanced given the lower required tax payments which should free up some funds to enhance new business efforts.

- The last five plus years have seen providers meaningfully “lean up” their organizations to remain cost competitive with their wrap (overhead) rates suggesting some amount of operating leverage.

The author knows his reputation in the industry is that of “Mr. Sunshine,” so he would like to offer some additional context to consider this good news.

- Outstanding bids on larger contracts that are sometimes stuck in multi-year long decision cycles still reflect pricing indicative of the tight BCA period of 2012-16 and in some cases 2017.

- Clients have not completely given up on LP/TA like pricing even when not appropriate, in our view.

- Most providers would suggest that current capability/ capacity of the contracting system could use some enhancement.

- Congress, with their late completion of regular way appropriations, has once again challenged a stretched contracting system by leaving a very brief window (by September 30th) to deploy the GFY18 appropriated funds onto the contracts. We hope efforts to get Congress to extend some of the deadlines prove successful as we expect appropriated dollars may be “left on the table” again this GFY.

- Given the tight deployment time-frame, look for a significant increase in scope of existing contracts as opposed to the decreased scope of recent years. This should favor incumbents. We expect new initiatives/ contracts to be more focused on the GFY19 award cycle.

- Our sense is that competition for major re-competes has yet to ease.

- With contract awards again expected to be biased to GFQ4 (September), the impact on revenue is not likely to be meaningful before the first calendar quarter of 2019, but then should be sustained for an extended period of time.

- Although sector CEOs have recently banded together to push Congress and the Administration to improve the much maligned security clearance process, improvement remains very slow. We believe finding and retaining the appropriately skilled and cleared personnel will be the number one limiting factor to potential revenue growth.

Industry Consolidation Should Accelerate

As demand prospects improve, driving enhanced financial visibility, we expect to see ongoing provider consolidation to extend capabilities into new clients and expand service offerings. We also expect to see renewed interest by those outside the government contracting community.

The market has already been surprised by two transactions this year. First, staffing firm On Assignment (ASGN) entered the federal space with the purchase of ECS Federal, which greatly expands the staffing firm’s addressable market. ASGN believes its staffing expertise can yield a competitive advantage to ECS allowing them to fill sometimes numerous open recs and therefore limit lost revenue. Second, General Dynamics Information Technology (GDIT) announced all cash purchase of CSRA (CSRA) that builds a $10 billion IT focused powerhouse. It again raises the question of “does size matter.” We still struggle with that one and those we speak with offer views from both ends of the spectrum. Given the initial success of Leidos’ acquisition of the services arm (IS&GS) of Lockheed Martin (LMT) creating an approximately $10 billion provider, we have a modest bias to “bigger is better.”

Of course the low-end of the market is dominated by the protected class of small business (SBA) providers that get nearly 25% of award activity directed to them. The challenge with the SBA incentives is you can only get so big. We expect an increasing number of them will become available as larger providers seek to fill in client and offering needs, while the sellers seek to monetize their hard work.

This leaves us with the mid-market. Let us call it from $200 million to $3 billion in revenue size. We expect this group to be increasingly challenged given a lack of client and offering breadth, as well as less attractive wrap rates.

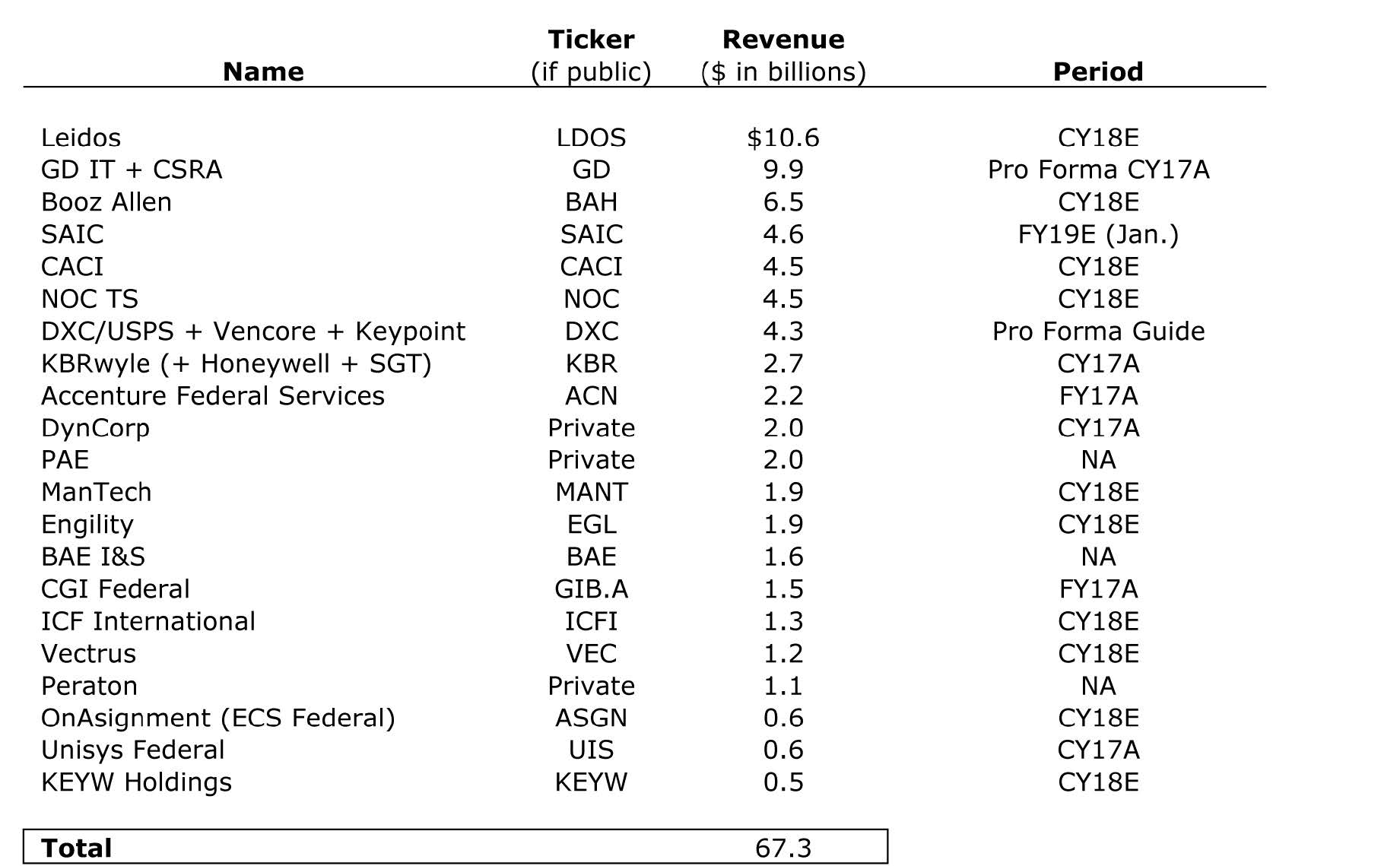

Exhibit 1 provides a list of the larger public, private and subsidiary service providers and some of the smaller public ones. We expect this list to be a little shorter in the next year or so. We also could be adding a few new names as units are spun-out to capture the current valuation of the publicly traded companies. In addition as rates rise, purely debt driven strategies will become more challenging, which should benefit those public providers with strong (equity) currencies. While the defense “primes” (other than GD) seem to have little interest in expanding their services exposure, the private equity firms may have interest given the improved sector prospects and historically strong cash flow characteristics. We do note that some private equity (PE) firms have been sellers of late (e.g. PE Veritas and their Vencore unit), but we believe this reflects more the aging of those investments within the PE’s portfolio.

Exhibit 1. Selected Government Service Providers, by revenue:

Note: GD, NOC, KBR, PAE, DynCorp, BAE, Peraton, Vectrus, Unisys and KeyW are not covered. GD and NOC are covered by Wells Fargo Securities, LLC Analyst Sam PearlsteinNote: All forward figures for NOC TS, Vectrus, Unisys Federal and KeyW reflect the midpoint of management guidanceNote: Pro Forma DXC/USPS + Vencor e+ Keypoint reflects October 2017 investor presentation. Note: Pro Forma KBR figures include approximately $500MM revenue from pending SGT acquisition; BAE and PAE per articles in Washington Business Journal (in April 2015 and June 2015, respectively), Peraton per press article on sale to VeritasNote: All other figurers are Wells Fargo Securities, LLC estimatesNote: Guide figures represent the midpoint of guidanceSource: Company data, Factset and Wells Fargo Securities, LLC estimatesrecs

What Do Investors Want Now?

During the 2000s when organic growth was consistently in the low teens, many companies came public with several later consolidated. We note service providers we once covered that were acquired by private equity or absorbed into larger entities:

American Management Systems, Anteon, CSRA (pending), DigitalNet, DynCorp, NCI, SI International, SRA, Stanley, Titan and Veridian.

During the first half of the current decade, revenue growth has been challenging, if not non-existent, so the better run organizations focused on returning capital to investors. We credit Booz Allen (BAH) and their then PE owner Carlyle Group with shifting the focus to margin enhancement and cash return optimization. Nearly all the other public providers followed suit.

Now, with the expectation of an expanded market opportunity, accelerating growth and an improved tax profile, the providers are debating a shift in capital deployment to growth enhancers, i.e. M&A. We believe investors are still adjusting to this change in corporate focus. While they would like to capture the growth, they have come to enjoy the strong cash returns. We believe the investor profile will continue to shift toward growth over value/return as the improved growth outlook leads to upward estimate revisions.

Valuation

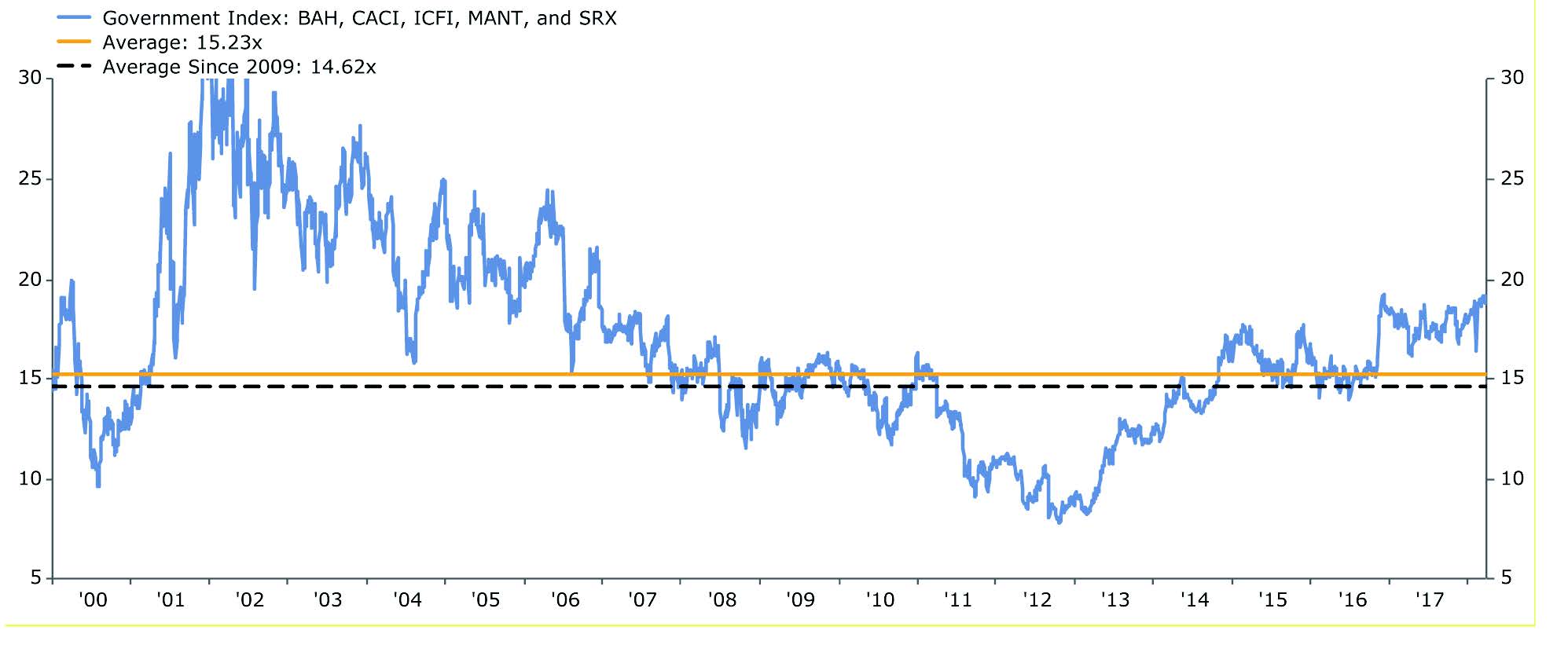

We look at valuation for the government service providers in three distinct periods. First, the period after the September 11th attack brought a significant uptick in federal spending (roughly a doubling of defense outlays) and significant opportunity for a new breed of government service providers, particularly those focused on supporting the war-fighter either directly or indirectly. As seen in Exhibit 2, this period saw above average valuation as defined by enterprise value (EV) divided by earnings before interest, taxes, depreciation and amortization (EBITDA).

Second, as troop levels in Afghanistan and Iraq dropped precipitously in the last 2000’s, revenue growth decelerated, competition increased and Congress began to acknowledge the size of the annual deficit. This led to the Budget Control Act (BCA) of 2011, an incomplete piece of legislation, in our view, which created years of no budget growth, but more importantly, uncertainty around spending priorities. The BCA contributed to valuations falling well below historic averages and M&A activity being all but non-existent as the visibility of contract waterfalls began to dry up. The valley of despair came with the sixteen day government shutdown in October 2013. While the turn in fundamentals was still several years away, value investors saw the attractiveness in the sector’s strong cash flow and the service providers’ willingness to return it. So the bounce off the bottom for valuation was driven by the strong return of capital during a period in which the overall economic recovery remained sluggish.

We believe the third leg began with the election of Donald Trump as President and the increased focus on national security spending. We note that the shares of the government contractors moved up about 20% in the days following the November 2016 election when the S&P500 index went up about 5%. The recent two year budget deal that dramatically raised the spending caps under the BCA, and the tax reform bill, should be viewed as the fulfillment of the Trump promises

(i.e. spend more on defense, reform taxes and reduce regulation). While we could see modest improvement in the EV/EBITDA multiple from here, we are more likely to see improved EBITDA levels given higher revenues, and increased M&A activity to improve positioning and accelerate growth.

Exhibit 2. Annual Price Performance Relative to the S&P500:

Source: FactSet and Wells Fargo Securities, LLC

Of course the challenge for Boards and management will be that investors always prefer their return sooner rather than later. This means a preference that publicly traded companies be sold (at a premium) rather than be a buyer focused on enhancing longterm shareholder value. We see the worst case scenario for investors is the Board/ management pursuing neither strategy as we believe this will only erode their competitive position and long-term value. One of the challenges of the “buy” approach is that most (not all) of the publicly traded providers already have financial leverage of about 3x net debt/EBITDA. While recent comments by managements suggest a willingness to temporarily let that rise to 5x, this could limit the amount of revenue expansion driven purely by debt financing.

So, will investors embrace new equity issuance to help drive value creation during this third period that should be defined by significant organic growth opportunity? In a way they already have with the Reverse Morris Trust (RMT) transactions of Engility

(EGL) and privately held TASC, Leidos with Lockheed’s IS&GS unit, and the proposed DXC Technology’s (DXC) USPS unit with privately held Vencore and Keypoint. All create new equity shares that need to be absorbed by the market. We note that CACI (CACI) pursued a cash (25%) and stock (75%) deal for CSRA, as well as did another unnamed bidder. Investors seek growth, and as noted above the sector is coming out of a period of retrenchment into one of expected significant growth. We would expect to see new capital move into the sector.

In conclusion, we see a significantly expanded market opportunity with the bigger contracts being won by a smaller group of leading larger service providers. We look for a modest improvement in the EBITDA margin after a step up in new business expenditures and potentially investments in intellectual property. We see sustained, and even more visible, strong operating cash flow and limited capex requirements. Industry consolidation should continue, and new entrants (investors) are likely given the dramatically improved demand and therefore revenue visibility. So the sun is shining, especially for the best managed providers.

Source for cover image: © iStockphoto.com

Click here to read the 2018 Annual Conference Thought Leadership Compendium.